Advertisement

Salesforce has incorporated generative AI (GenAI) in its Financial Services Cloud to transform how financial institutions and banks handle customer relationships, orchestrate operations, and provide personalized services. The AI integration leverages Salesforce's Einstein platform to improve productivity and simplify mundane tasks throughout banking operations. Whether wealth management or retail banking, the incorporation of GenAI enhances the client experience, mitigates the need for manual effort, and speeds up decision-making activities. By directly integrating intelligence into ordinary tools, Salesforce empowers financial professionals to have more time to think about customer value. This new upgrade is a tremendous leap toward utilizing AI in real-world financial services environments.

Salesforce Financial Services Cloud is a CRM solution for banks, wealth managers, and insurance companies. The application assists financial institutions in dealing with customer relationships, monitoring financial objectives, and automating client communications. On top of Salesforce's foundation platform, it features account planning functionality, compliance monitoring, and automation of tasks, all of which aim to make financial advisors and bankers more efficient. With customer data in one place and accessible, the platform facilitates at-scale personalized service. With GenAI added, users can engage with that data more intelligently, enhancing internal processes and external client relations through context-aware AI-supported assistance.

GenAI integration brings next-generation natural language capabilities to the Financial Services Cloud, making client interactions and internal processes more efficient. Financial experts can create meeting summaries, compose client emails, and get investment insights through straightforward prompts. Next-best actions are also proposed based on real-time information and history, keeping advisors proactive. GenAI enables teams to devote themselves to high-value client interactions by freeing staff from mundane administrative work. This more intelligent interface cuts time switching between systems, allowing bankers and wealth managers to offer faster and more personalized guidance driven by intelligent automation.

Bankers will employ GenAI daily to simplify client communications, automate meeting preparation, and minimize time spent on paperwork. For instance, the AI can create automatic meeting summary drafts and recommend personalized follow-up emails, freeing weekly hours. It can also scan recent transactions and highlight potential for new services or products. Rather than digging through dashboards and reports, bankers can query the AI with direct questions about a client's portfolio or financial objectives. This allows for quicker decision-making and stronger client relationships, as financial consultants have more time for strategic rather than administrative work.

Through GenAI, Salesforce helps financial institutions provide more responsive and personalized customer experiences. Advisors can access insights specific to a customer's history, preferences, and economic objectives, resulting in improved recommendations. Real-time AI support enables institutions to foresee customer needs and automatically contact them with appropriate advice or product offerings. GenAI also enhances consistency and speed of communication, allowing clients to receive prompt, professional replies. As client demands bespoke service increase, GenAI will enable banks and advisors to provide human-like interactions at scale and with a personal touch while tapping the potential of automation and thoughtful insights.

Salesforce has constructed its GenAI tools with enterprise-level security and is thus capable of operating within highly regulated financial settings. Financial Services Cloud's GenAI supports stringent data governance controls and role-based access to sensitive financial data so that only authorized parties can see the data. Data in transit and data at rest are encrypted, and client-specific data is never used to train outside models. Salesforce also offers compliance monitoring and audit trails. This allows banks to maintain control over their data while taking advantage of AI breakthroughs, providing confidence for institutions to use GenAI in their risk portfolios.

Financial advisors receive increased productivity using GenAI as it frees them from repetitive tasks such as writing reports, creating meeting notes, and entering CRM updates. Advisors do not have to type or say natural language cues but can instead let the AI create formatted outputs. The assistant also determines cross-sell and upsell opportunities based on client interactions and account activity, enabling advisors to prioritize tasks. Real-time advice and an auto-documenting feature allow advisors to devote more time to building relationships and less time typing data. This transformation will enable firms to increase the delivery of personalized services without increasing team headcount, improving advisory practices' operational efficiency.

For wealth management, GenAI streamlines reviews of portfolios creates customized investment recommendations, and assists in compliance documentation. Advisors can evaluate client wealth health through conversational questions instead of complex reports, simplifying wealth planning. GenAI also detects potential risks or investment strategy gaps and offers alternatives proactively. The information can be presented to clients immediately, enhancing trust and decision-making. The AI may aid regulatory procedures by automatically generating KYC or AML summaries. Overall, GenAI enables wealth managers to provide improved financial advice more quickly, without sacrificing the high levels of quality necessary in the investment industry.

Compliance is paramount in banking, and Salesforce has engineered GenAI to enable regulatory compliance. The system keeps records of AI-generated output, enabling complete transparency and auditability. Banks and advisors can monitor AI interactions to validate against internal rules and industry requirements. Administrators can also set up content filtering, data permission, and compliance rules to restrict what AI may access or propose. Salesforce's ethical AI principles ensure GenAI remains responsible and avoids biased responses. This provides financial institutions with a framework to leverage generative AI tools safely, directing innovation consistent with the expectations of financial regulators worldwide.

Salesforce's launch of GenAI within the Financial Services Cloud is a significant step towards the future of banking and client advisory. By merging natural language capabilities with robust automation, GenAI enables financial professionals to work more quickly, serve customers better, and work with greater smarts. From everyday operations to sophisticated financial planning, AI becomes a strategic collaborator, not merely an instrument. With enterprise-grade security and an intense emphasis on personalization, Salesforce makes its AI platform drive innovation while honoring the stringent regulatory requirements of the world of finance. Such a change places banks in a position to be leaders in the intelligent customer engagement era.

Advertisement

Salesforce brings generative AI to the Financial Services Cloud, transforming banking with smarter automation and client insights

Learn how __init__ in Python works to initialize objects during class creation. This guide explains how the Python class constructor sets instance variables, handles defaults, and simplifies object setup

Explore the key differences between AI, machine learning, and deep learning with practical insights and use case examples.

Explore Pega GenAI Blueprint's top features, practical uses, and benefits for smarter business automation and efficiency.

Need to share a ChatGPT chat? Whether it’s for work, fun, or team use, here are 7 simple ways to copy, link, or export your conversation clearly

Explore how Rabbit R1 enhances enterprise productivity with AI-powered features that streamline and optimize workflows.

Explore how developers utilize the OpenAI GPT Store to build, share, and showcase their powerful custom GPT-based apps.

Discover top industries for AI contact centers—healthcare, banking fraud detection, retail, and a few others.

Discover different methods to check if an element exists in a list in Python. From simple techniques like using in to more advanced methods like binary search, explore all the ways to efficiently check membership in a Python list

Compare Intel’s AI Gaudi 3 chip with Nvidia’s latest to see which delivers better performance for AI workloads.

Highlighting top generative AI tools and real-world examples that show how they’re transforming industries.

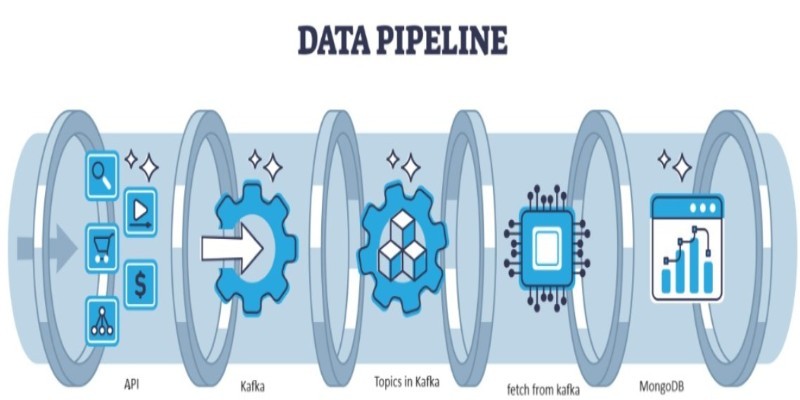

Learn how to connect Kafka to MongoDB and build a simple, reliable data pipeline that moves real-time messages into a NoSQL database efficient-ly